As we head into this week, the markets are primed for some big developments, with the Federal Reserve’s upcoming interest rate decision taking center stage and companies continuing to report for this earnings season.

The Federal Open Market Committee (FOMC) will announce its policy decision on Wednesday. Despite President Donald Trump’s recent calls for immediate rate cuts, the Fed is widely expected to keep the current federal funds rate within the 4.25% to 4.50% range. This reflects the Fed’s careful approach amid a strong job market and ongoing concerns about inflation.

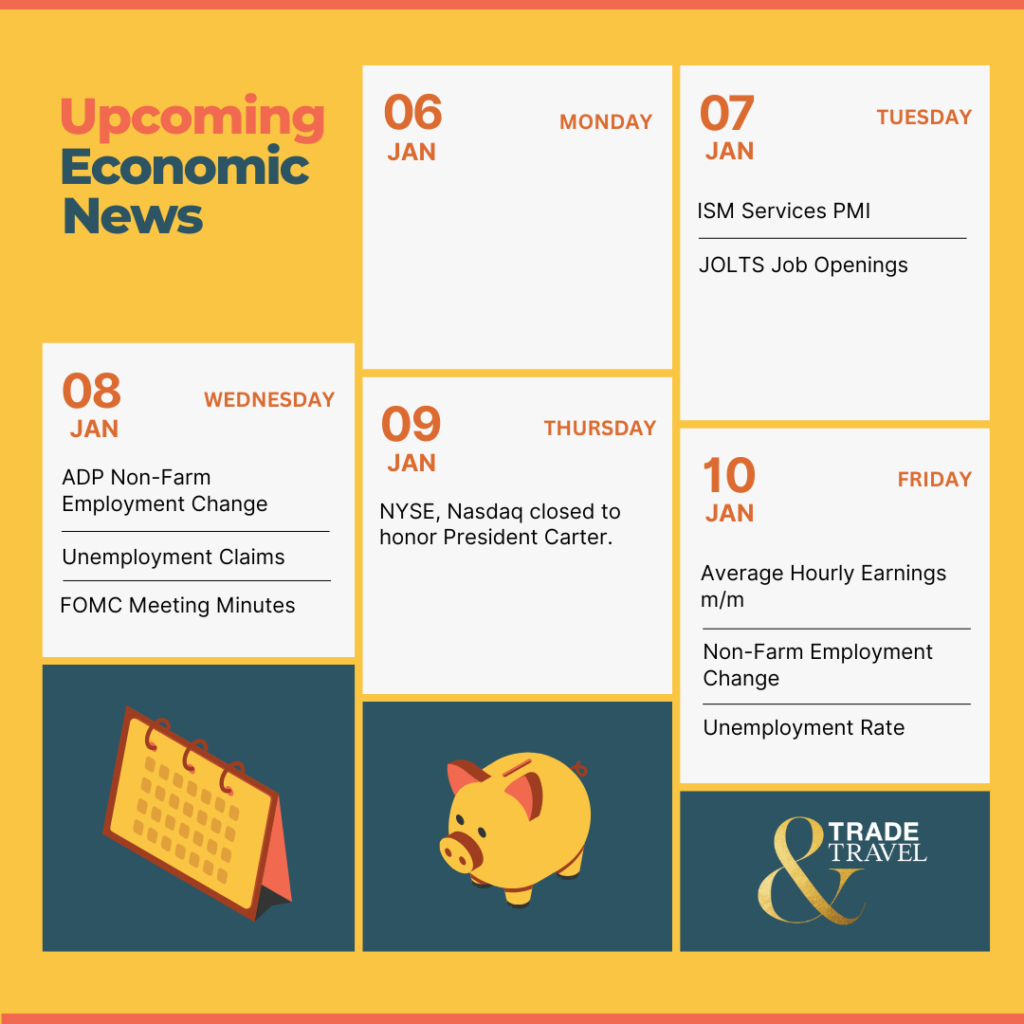

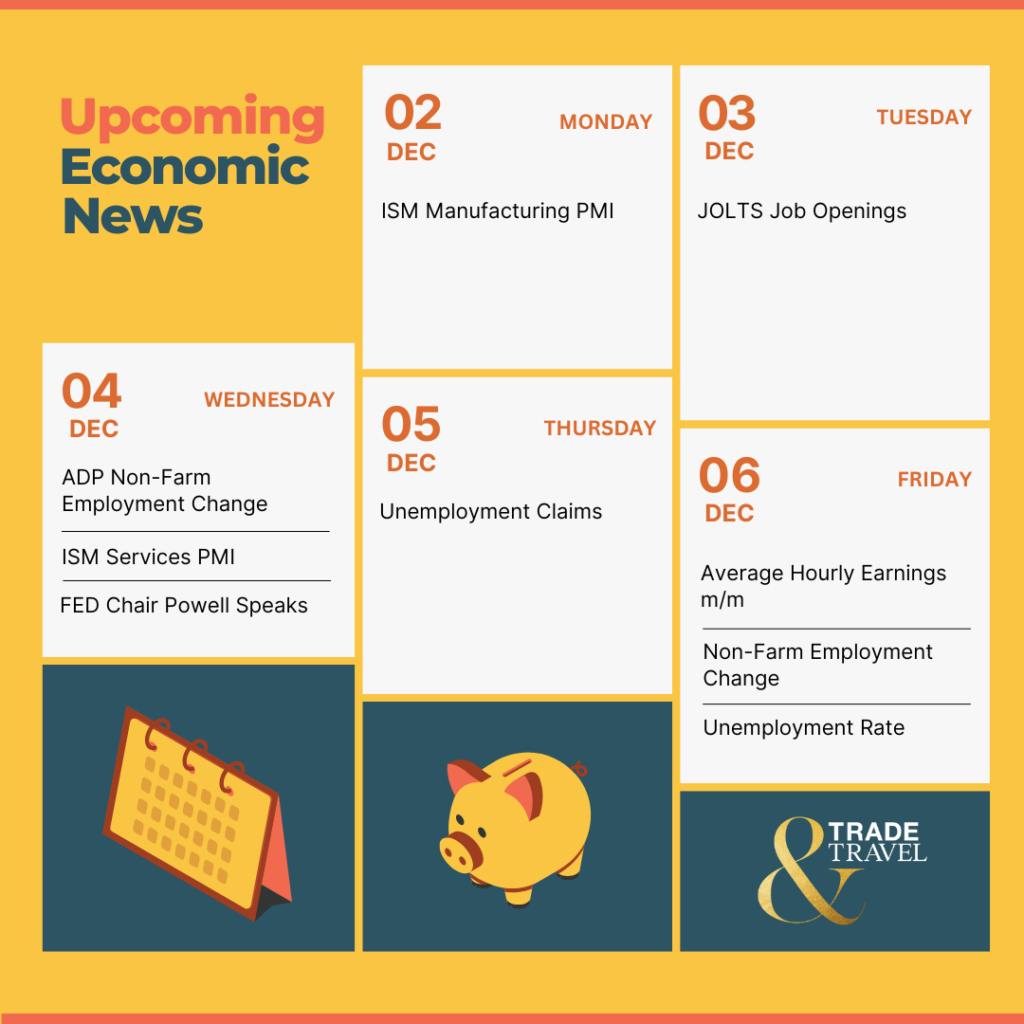

With that said, here’s a brief overview of the key economic reports for this week:

📅 Tuesday, Jan 28th

- CB Consumer Confidence: The CB Consumer Confidence Index will reveal whether American consumers feel more optimistic amidst recent economic shifts. This pivotal data could sway market expectations, affecting spending and investment decisions across the board.

📅 Wednesday, Jan 29th

- Federal Funds Rate and FOMC Statement: The Federal Funds Rate announcement is set to determine if the Fed keeps rates steady at the current 4.25% to 4.50% range. Amidst calls for rate cuts by President Trump, markets are bracing for a likely pause in policy changes, reflecting the Fed's cautious stance on inflation and employment.

📅 Thursday, Jan 30th

- Advance GDP q/q: The Advance GDP Q/Q report will provide the first look at U.S. economic growth for Q4 2024, with forecasts suggesting a dip from 3.1% to around 2.7% growth rate. This initial estimate could signal a cooling economy, influencing market expectations and policy decisions in the coming months.

- Unemployment Claims: The Unemployment Claims Report is forecasted to show a decrease to 221,000 initial claims, reflecting a strengthening labor market. This lower figure suggests fewer layoffs and could indicate an increase in hiring, painting an optimistic picture for the economy as we navigate through current policy debates.

📅 Friday, Jan 31st

- Core PCE Price Index m/m: The Core PCE Price Index report is anticipated to show inflation holding steady, with an expected increase of 0.2% month-over-month. This key metric, closely watched by the Federal Reserve, could influence future monetary policy decisions, particularly concerning interest rates, amidst a backdrop of a robust economy.

- Employment Cost Index q/q: The Employment Cost Index (ECI) Q/Q report will shed light on wage and benefit growth for the last quarter of 2024. Expectations are set for a modest increase of 0.9%, signaling a cooling in labor cost pressures which could influence the Federal Reserve's upcoming policy decisions.

Here are some stocks reporting earnings this week to watch:

📅 Tuesday, Jan 28th

- Boeing Co (BA): Boeing's earnings report is anticipated to reflect ongoing challenges, with expectations of a loss per share of -$2.93 due to previous quarters' issues including production halts and safety concerns. Investors will be keen to see if there are signs of recovery or if the company's strategic adjustments are yet to yield positive financial results.

- Starbucks Corp (SB): Starbucks is set to report its latest earnings with expectations of $0.67 EPS and $9.32 billion in revenue. Investors will scrutinize how the new CEO's strategies are influencing sales trends and operational efficiency.

📅 Wednesday, Jan 29th

- Tesla Inc (TSLA): Tesla's Q4 2024 earnings report is eagerly awaited, with projections suggesting an EPS of $0.77 on revenues of $27.14 billion. Despite production challenges, the focus will be on Tesla's guidance for 2025, particularly regarding new models, autonomous tech advancements, and Elon Musk's influence on future growth.

- Meta Platforms, Inc. (META): Meta is set to announce its Q4 2024 earnings with expectations of an EPS of $6.73 and revenue around $47 billion. The report will be scrutinized for insights into ad revenue growth, AI developments, and the financial implications of Meta's significant investments in the metaverse and AI infrastructure.

📅 Thursday, Jan 30th

- Apple Inc (AAPL): Apple's Q1 2025 earnings report is expected to show an EPS of $2.35 and revenue of $124 billion. Investors will be particularly interested in iPhone 16 sales performance, service growth amidst regulatory scrutiny, and any forward guidance in light of recent market dynamics.

- United Parcel Service Inc (UPS): UPS will announce its Q4 2024 earnings with analysts expecting an EPS of $2.53 and revenue of $25.4 billion. The spotlight will be on how UPS has navigated the holiday season's logistics, cost management strategies, and the impact of e-commerce growth on its bottom line.

📅 Friday, Jan 31st

- Exxon Mobil Corp (XOM): ExxonMobil is scheduled to release its Q4 2024 earnings with forecasts indicating an EPS of $1.55 and revenue of $87.2 billion. Investors will look for updates on production levels, refining margins, and how the energy giant is adapting to the volatile oil and gas market conditions.

We hope this helps and happy trading!

– Trade and Travel Team

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.