This week is packed with critical market reports that investors must closely watch.

With the NYSE and Nasdaq closed on Thursday, Jan. 9, for a National Day of Mourning for former President Jimmy Carter, the trading week is shortened, which means fewer days for the market to respond to important data.

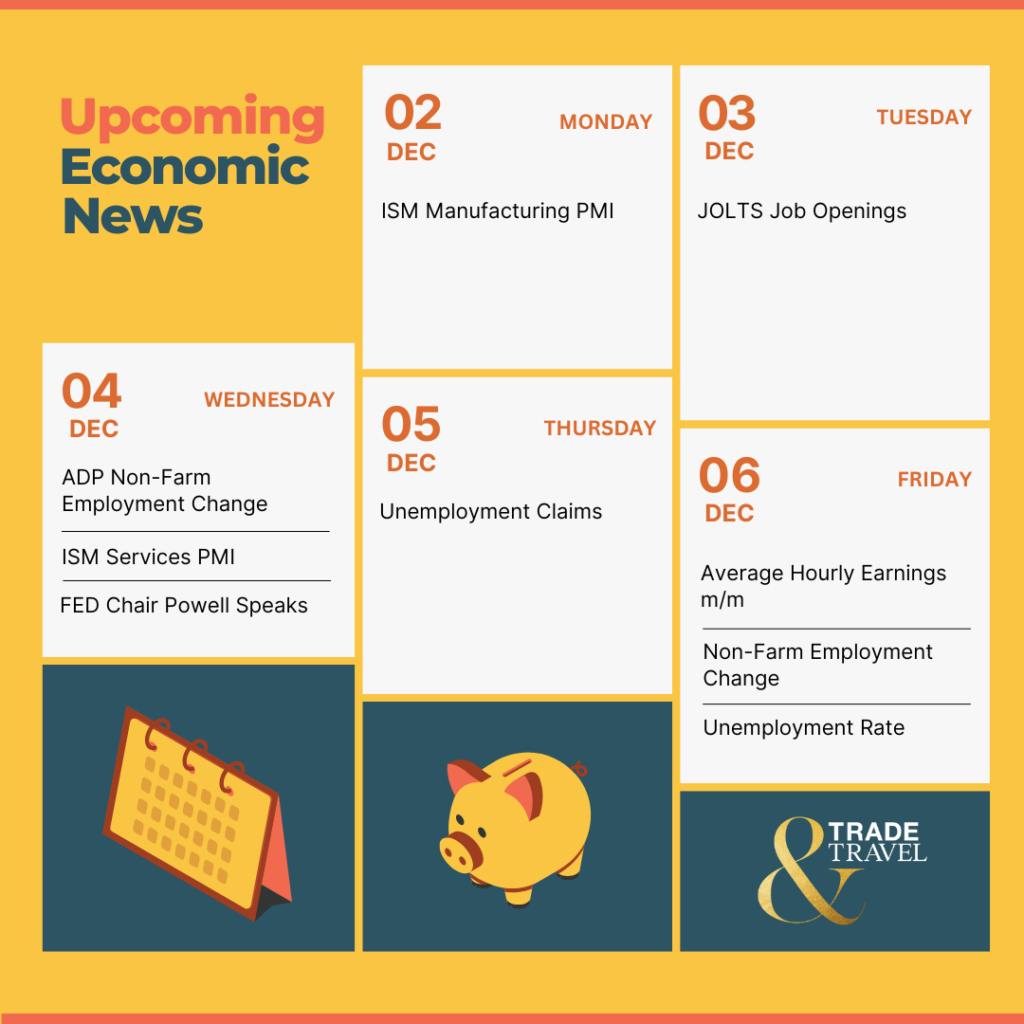

📅 Tuesday, Jan 7th

- ISM Services PMI: The ISM Services PMI has slowed for the past three months, with November’s drop to 52.1 driven by weaker business activity, orders, and jobs. The upcoming report will reveal if the sector is stabilizing or continuing to weaken.

- JOLTS Job Openings: Job openings rose to 7.7 million in the last report, led by gains in services and tech, with growth in the South and West. Watch if the next report shows continued hiring demand or signs of cooling.

📅 Wednesday, Jan 8th

- ADP Non-Farm Employment Change: Private businesses added 146K jobs in November, the slowest growth in three months, with services leading gains while manufacturing shed 26K jobs. The next report will show if hiring rebounds or continues to slow.

- Unemployment Claims: Initial jobless claims dropped to 211K in late December, the lowest in eight months, signaling a still-tight labor market. The upcoming report will reveal if claims remain low, which could influence the Fed’s stance on interest rates.

- FOMC Meeting Minutes: The minutes are expected to highlight the Fed’s focus on inflation control and cautious approach to rate cuts. Watch for discussions on inflation risks and policy disagreements, which could suggest a slower pace of future cuts if inflation remains persistent.

📅 Thursday, Jan 9th

- NYSE and Nasdaq closed to honor former President Jimmy Carter.

📅 Friday, Jan 10th

- Average Hourly Earnings m/m: Wages rose 0.4% in November, with annual growth at 4%, slightly above forecasts. Watch for signs of further wage increases that could affect inflation and rate decisions.

- Non-Farm Employment Change: November payrolls rose by 227K, recovering from strike and hurricane disruptions. Gains were in health care, hospitality, and manufacturing. Watch whether job growth remains steady or softens in the next release.

- Unemployment Rate: The rate rose to 4.2% in November. The next report will show whether job losses continue or the labor market stabilizes. Stability here is critical as markets continue assessing labor market tightness.

In the weeks ahead, we’ll discuss how Trump’s presidency, as he takes office at the presidential inauguration on Monday, 20 January, could increase market volatility and why you need to be equipped with various strategies to help you prepare for and navigate it.

Stay tuned and happy trading!

– Trade and Travel Team

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.