As Donald Trump returns to the White House, the world is watching his next moves, which could shake up the stock market, particularly after his recent call with Chinese President Xi Jinping.

During his campaign, Trump proposed a 60% tariff on Chinese imports but, as president-elect, suggested a more moderate 10% increase if Beijing fails to crack down on the highly addictive narcotic fentanyl.

Such tariff changes could raise costs for businesses and consumers, putting pressure on industries like technology and retail while dampening investor sentiment. U.S.-China relations will remain a key driver of market volatility during his upcoming term, as shifts in trade policy ripple through supply chains.

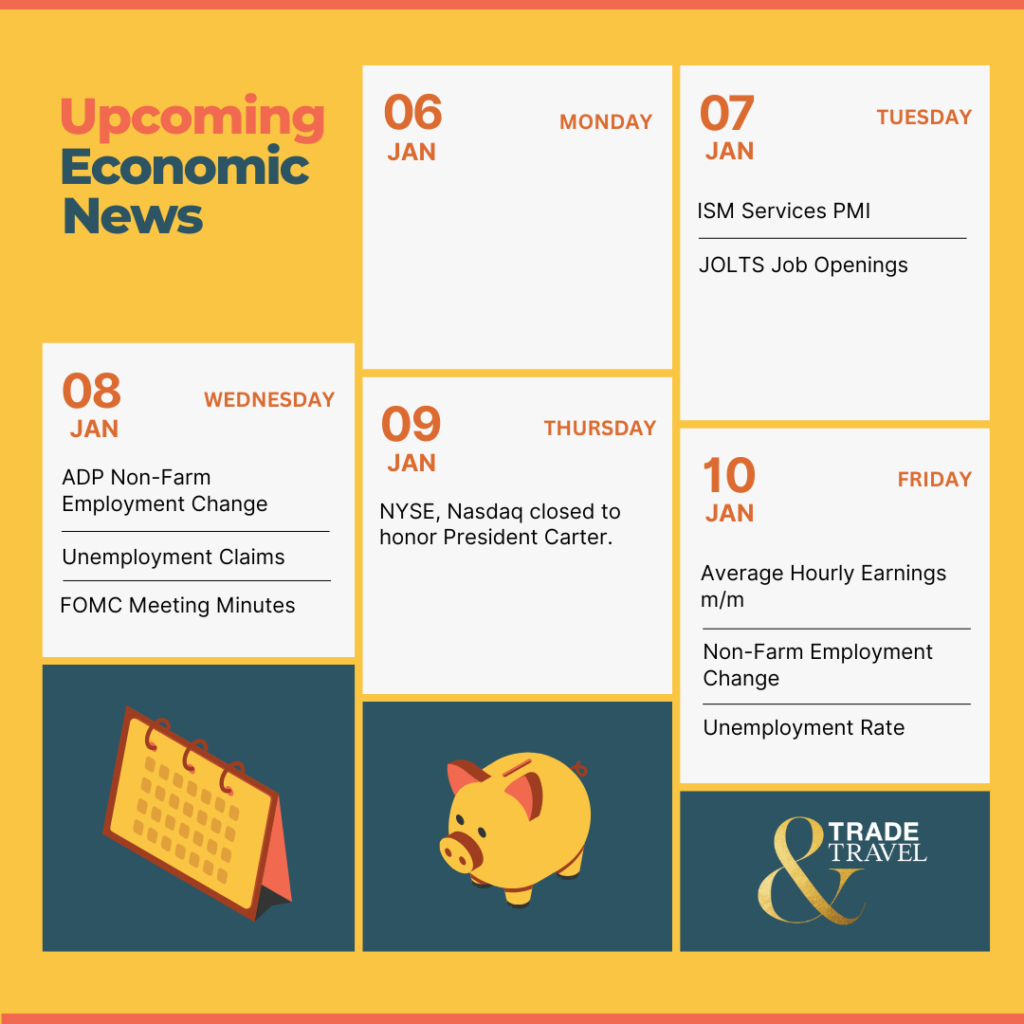

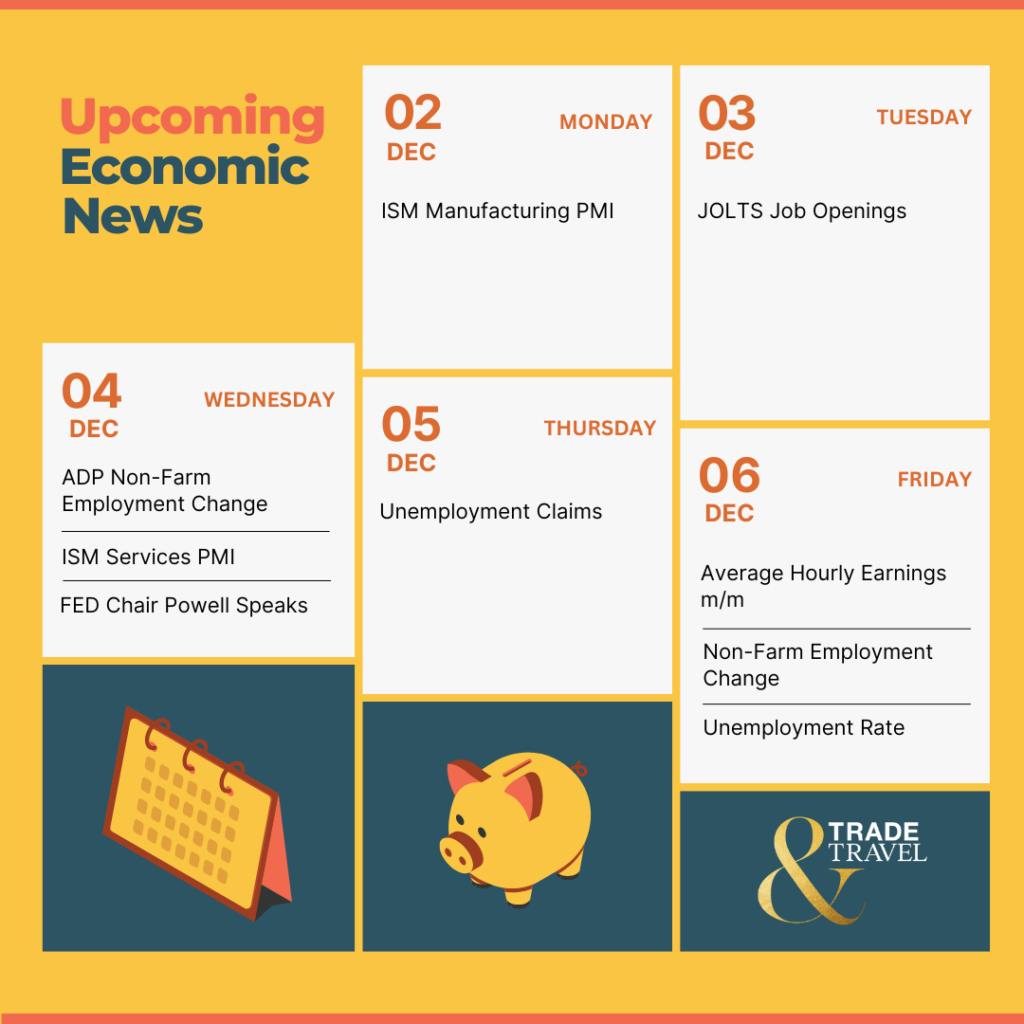

With that in mind, here’s a quick look at this week’s key economic reports:

📅 Thursday, Jan 23rd

- Unemployment Claims: Jobless claims rose by 14,000 to 217,000 last week, but the job market remains strong with continuing claims falling to 1,859,000. Next week, keep an eye on whether claims stay steady or start to climb.

📅 Friday, Jan 24th

- Flash Manufacturing PMI: The S&P Global US Manufacturing PMI fell to 49.4 in December, marking the sixth month of contraction as output dropped and new orders slowed due to uncertainty around Trump’s incoming administration. In the next report, watch for any improvement in new orders or whether inflationary pressures continue to drive up factory costs.

- Flash Services PMI: Unlike the Manufacturing PMI, which showed continued contraction, the S&P Global US Services PMI climbed to 56.8 in December, the highest since March 2022, driven by stronger demand and a boost in new orders, including from abroad.

In the next report, watch whether inflation continues to ease and business confidence remains strong under the new administration.

Here are some stocks reporting earnings this week to watch:

📅 Tuesday, Jan 21st

- Netflix (NFLX): Netflix is expected to report an EPS of $4.21 for Q4 2024, nearly doubling the $2.11 from the previous year, with revenue growth projected at about 15%. The company's strategic initiatives into live sports, including NFL games and the Jake Paul-Mike Tyson fight, along with its expanding gaming streaming service, will be areas of focus in this earnings report.

- United Airlines Holdings, Inc. (UAL): United Airlines is expected to report an EPS of $3.03 for Q4 2024, a 51.5% increase year-over-year, amidst a focus on managing debt and liquidity, with a $1.5 billion share repurchase plan in place. Key aspects to watch include how fuel costs have influenced profitability and the company's approach to maintaining financial stability through effective cost management.

📅 Wednesday, Jan 22nd

- Procter & Gamble Co (PG): P&G’s upcoming earnings will highlight cash flow, shareholder returns, and guidance for 2025, with an expected EPS of $1.86, marking a 1.09% year-over-year increase. Focus will also be on market share, volume growth, and any updates on product innovation efforts.

- AT&T (T): AT&T’s results will highlight subscriber growth in postpaid phones and fiber, alongside updates on 5G and fiber network expansion. The company has also been discussing a bold, multi-year strategic plan focused on sustainable growth. Attention should also be on any changes in dividend policy and an EPS of $0.51, which indicates a 5.55% year-over-year decrease.

📅 Thursday, Jan 23rd

- American Airlines Group Inc (AAL): American Airlines is expected to report an EPS of $0.66 for Q4 2024, a significant 127.59% year-over-year increase, with revenues around $13.42 billion, focusing on passenger revenue growth and operational efficiency. Key points include the impact of fuel costs, capacity planning, debt reduction, and 2025 guidance which will outline the airline's strategy in a dynamic market.

📅 Friday, Jan 24th

- American Express Co (AXP): American Express’s upcoming earnings will spotlight card member spending growth and new card acquisitions, particularly for premium products. Attention will also be on how the company manages provisions for credit losses amid economic uncertainty. The focus will be on an expected EPS of $3.05, reflecting a 16.41% year-over-year increase, as a key indicator of profitability.

With key earnings, economic reports, and Trump’s inauguration in focus, this week could bring significant market shifts.

Stay ready and happy trading!

– Trade and Travel Team

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.