This past week was a wild ride for the stock market because of AI news hitting the market one after another.

It started with a Chinese company, DeepSeek, revealing its latest AI model. It's reported the model doesn't need much computing power to work and performs as well or better than ChatGPT's latest models.

This was a big deal because Nvidia makes a lot of money selling high-power GPUs for AI applications. If DeepSeek's latest model can do similar work with less power, there would be less demand for Nvidia's chips, which would hit Nvidia's stock hard. Since Nvidia is a big player in tech, that drop in Nvidia's stock value pulled the broader market down.

Then, right in the middle of all this, a new ChatGPT model called the o3 mini was released, claiming it's even better than what DeepSeek put out.

By the end of the week, the market started to calm down a bit as investors began to see the potential in all these AI advancements. It's been a wild ride, and we'll watch how the AI competition space unfolds over the coming weeks.

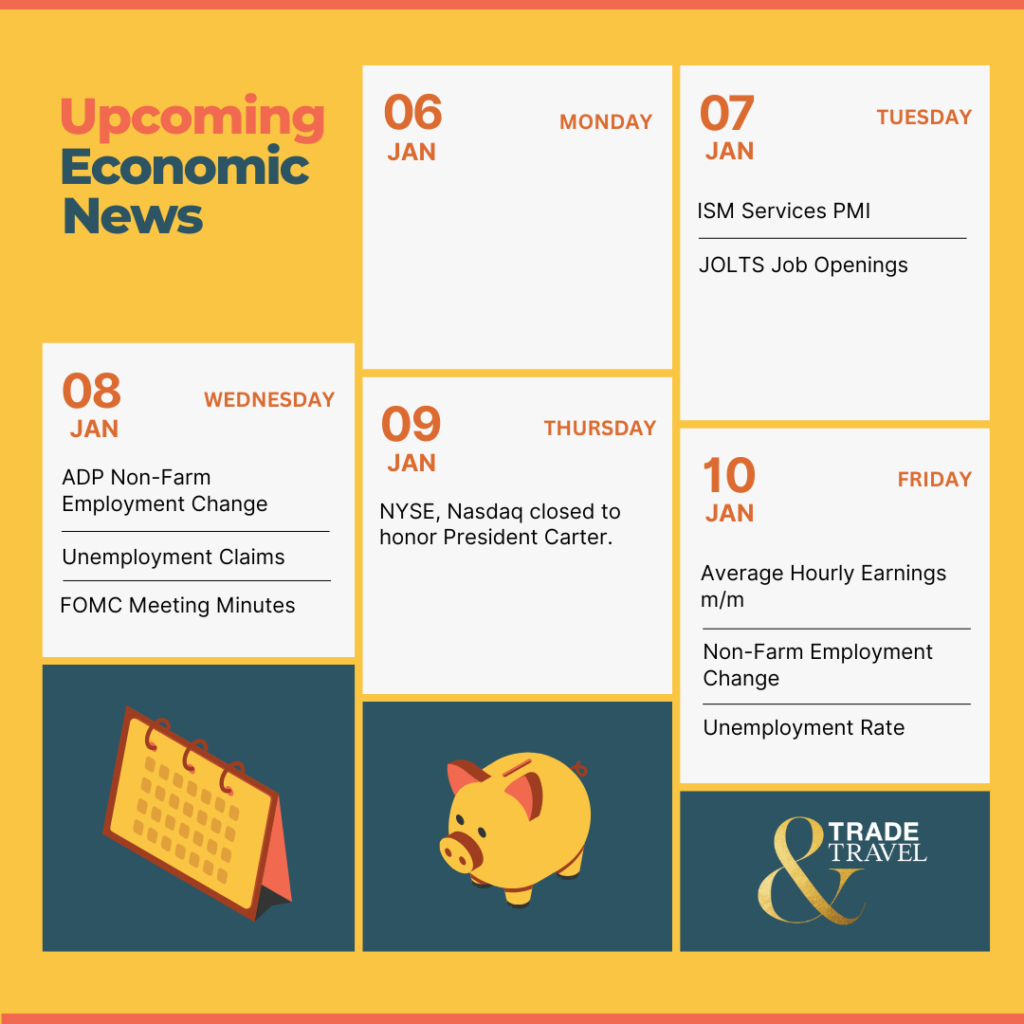

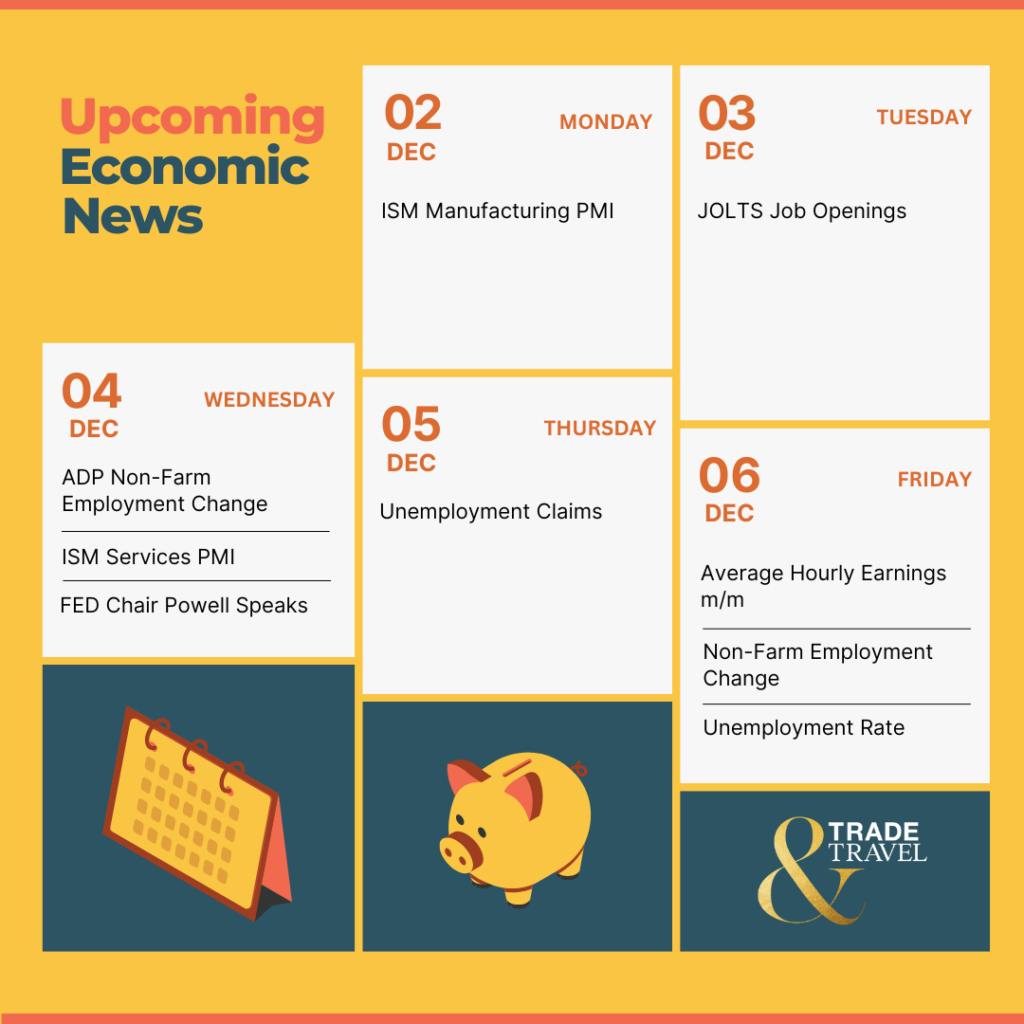

With that in mind, let's move into this week's economic reports:

📅 Monday, Feb 3rd

- ISM Manufacturing PMI: The upcoming report is anticipated to reflect a potential uptick in manufacturing activity, with expectations set at around 50.1, suggesting a stabilization or slight expansion in the sector. Pay close attention to new orders, employment, and price indices as these will provide insights into demand, labor market conditions, and inflationary pressures.

📅 Tuesday, Feb 4th

- JOLTS Job Openings: The upcoming JOLTS Job Openings report is expected to slightly decrease job vacancies to around 7.88 million, reflecting a cooling labor market. Watch for changes in the quits rate and hires, as these indicators will provide insights into labor demand and worker confidence amidst ongoing economic adjustments.

📅 Wednesday, Feb 5th

- ADP Non-Farm Employment Change: The ADP Non-Farm Employment Change report is anticipated to reveal the addition of around 149,000 jobs, providing early insights into the health of the private sector labor market. Keep an eye on the sectoral distribution of job gains or losses, as well as wage growth to understand potential impacts on Federal Reserve decisions.

- ISM Services PMI: The ISM Services PMI report is expected to indicate continued expansion in the services sector, with forecasts around 54.2, reflecting robust business activity. Pay attention to the new orders, employment, and price components, as they'll shed light on service demand, labor market conditions, and inflation pressures influencing economic policy and market sentiment.

📅 Thursday, Feb 6th

- Unemployment Claims: The Unemployment Claims report, expected this Thursday, is projected to show initial claims hovering around 214,000, indicating a stable but watchful labor market. Investors should scrutinize the four-week moving average and any changes in continuing claims for signs of underlying trends in employment and economic health.

📅 Friday, Feb 7th

- Average Hourly Earnings m/m: The Average Hourly Earnings m/m report is expected to show a 0.3% increase, suggesting steady wage growth amidst current economic conditions. Look closely at this figure for insights into inflation pressures and labor market tightness.

- Non-Farm Employment Change: The Non-Farm Employment Change report is expected to reflect a job growth of about 154,000 for January, down from December's 256,000, indicating a cooling labor market. Key areas to watch include revisions to previous months' data, the unemployment rate, and wage growth, as these will paint a broader picture of economic health.

- Unemployment Rate: The Unemployment Rate report is forecasted to remain steady at 4.1%, signaling a stable labor market despite potential cooling in job growth. Investors should watch for unexpected shifts in the rate or demographic-specific unemployment changes, which could indicate broader economic trends or policy implications.

Here are some stocks reporting earnings this week to watch:

📅 Tuesday, Feb 4th

- Alphabet (GOOGL, GOOG): Alphabet is set to report its earnings with expectations of a 12% revenue growth and EPS at $2.13. Investors and traders should focus on the performance of Google Services, Cloud growth, AI advancements, and any commentary on competitive pressures from emerging AI technologies like DeepSeek and Alibaba's new version of Qwen.

- Advanced Micro Devices (AMD): AMD is scheduled to report with expectations set for an EPS of $1.09 and revenue around $7.5 billion. Investors should pay close attention to the performance of the Data Center segment, particularly the demand for AI chips, and any forward guidance on 2025, given the competitive landscape with rivals like NVIDIA and emerging AI technologies from China.

📅 Wednesday, Feb 5th

- Walt Disney Co (DIS): Disney will announce its earnings with forecasts suggesting an EPS of $1.43 and revenue growth of $24.55 billion. Investors should scrutinize the performance of Disney's streaming services, theme park attendance, and any updates on content strategy or executive succession plans, as these will be pivotal for understanding future growth prospects.

- Uber Technologies (UBER): Uber is set to disclose its earnings with projections for revenue growth to $11.78 billion but a profit decline to $0.60 per share. Investors should monitor Gross Bookings, Adjusted EBITDA, and any insights on competitive pressures from autonomous vehicles, alongside Uber's strategic moves in advertising and membership programs.

📅 Thursday, Feb 6th

- Amazon (AMZN): Amazon is scheduled to announce its Q4 2024 earnings with analysts anticipating revenue of $166.2 billion and an EPS of $1.53. Investors should pay close attention to AWS growth, advertising revenue, any updates on AI integration, and the impact of holiday sales on margins and future guidance for insights into Amazon's operational efficiency and strategic direction.

Happy trading!

– Trade and Travel Team

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.