The U.S. stock market experienced a turbulent week. On Tuesday and Wednesday, the S&P 500 reached new highs, driven by solid results from the tech and semiconductor sectors. These gains gave investors a sense of optimism early in the week.

That changed by Friday when negative economic reports surfaced. Consumer confidence, according to the University of Michigan, fell to its lowest level since November 2023. A key measure of service-sector activity (Flash Services PMI) also dropped below expectations, showing a contraction for the first time in over two years. What led the sharp sell-off are concerns about rising prices due to tariffs, along with uncertainty from the new administration’s spending cuts and policies that could increase inflation.

By the end of the week, the earlier gains had disappeared. The Dow Jones Industrial Average (DIA) declined 2.61%, the S&P 500 (SPY) fell 1.6%, and the Nasdaq (QQQ) dropped 2.24%. These losses reflected growing worries about the economy, fueled by fears of tariffs, global issues, and a slowdown in new orders.

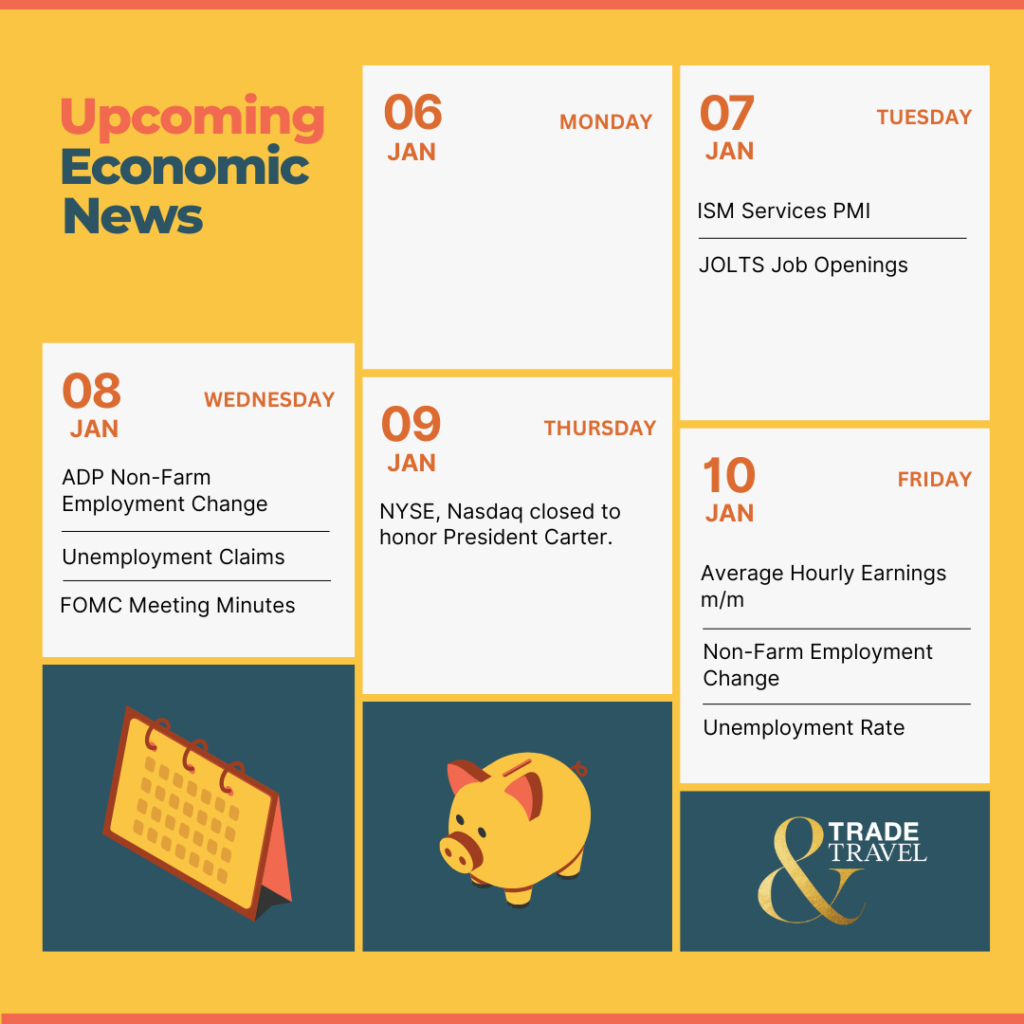

With that in mind, here are the upcoming economic news releases this week:

📅 Tuesday, Feb 25th

CB Consumer Confidence: The CB Consumer Confidence report is forecasted to show the index at 103.3, a slight decline from the previous reading of 104.1, reflecting a modest dip in U.S. consumer optimism. Investors and traders should watch the actual figure against the forecast, as a lower-than-expected value could signal weaker spending and pressure markets. This report, released monthly on the last Tuesday, is crucial for understanding consumer spending trends, which drive economic activity.

📅 Thursday, Feb 27th

Prelim GDP q/q: The preliminary GDP report for Q4 2024 updates the initial 2.3% annualized growth estimate with more complete data, reflecting U.S. economic performance from October to December. Investors should monitor revisions to the 2.3% growth rate and analyze components like consumer spending, up 4.2%, and business non-residential investment, down 2.2%, for clues on economic trends. These shifts can signal the economy's trajectory, influencing market expectations and potential Federal Reserve actions.

Unemployment Claims: The unemployment claims report is forecasted to show 220,000 initial claims for the week ending February 22, a slight rise from the prior week's 219,000, hinting at a modest uptick in layoffs. Watch if the actual figure deviates from 220,000 and track the 4-week moving average to assess labor market stability amid government layoffs.

📅 Friday, Feb 28th

Core PCE Price Index m/m: The Core PCE Price Index m/m report is forecasted to show a 0.3% rise for January, up from December’s 0.2%, signaling a slight uptick in underlying inflation. Investors and traders should monitor whether the actual figure deviates from 0.3%. A higher reading could prompt a hawkish Federal Reserve response, impacting markets, while a lower number might ease rate hike fears.

Here are some stocks to watch that are reporting earnings this week:

📅 Monday, Feb 24th

Domino's Pizza (DPZ): Domino's Pizza is set to report its Q4 2024 earnings with an expected EPS of $4.91, up 9.6% from last year, and revenue of $1.47 billion, up 5%. Given recent consumer spending concerns, investors should watch same-store sales growth and digital strategy updates. The company's focus on online ordering could be crucial amidst economic uncertainty.

📅 Tuesday, Feb 25th

Home Depot (HD): Home Depot is to report its Q4 2024 earnings with revenue expected to rise 12.33% year-over-year to $39.07 billion. EPS is projected to reach $3.04, up 7.8% from last year, likely reflecting growth despite pressures from a softer housing market. Higher interest rates, increased operational costs, and a decline in same-store sales are likely to have influenced profit margins. Investors might want to monitor same-store sales trends, the Pro customer segment, and 2025 guidance. Home Depot’s ability to navigate these challenges will likely be crucial to its future performance.

📅 Wednesday, Feb 26th

Nvidia (NVDA): Nvidia is to report its earnings with revenue expected to rise 72.63% year-over-year to $38.15 billion, with EPS projected to reach $0.85, a 64.73% increase, likely reflecting strong growth and rising operational costs and investments in AI infrastructure. Higher production costs, increased R&D expenses, and variable demand for GPUs are likely to have influenced profit margins. Investors might want to monitor data center segment trends, supply chain dynamics, and AI market demand. Nvidia’s ability to navigate these factors will likely be crucial to its future performance.

📅 Thursday, Feb 27th

SoundHound AI (SOUN): SoundHound AI is likely to report its Q4 2024 earnings with revenue expected to rise over 96.5% year-over-year to approximately $33.7 million, driven by strong voice AI adoption. EPS is projected to be -$0.08, likely reflecting increased investments in scaling despite a revenue backlog of “well north of $1 billion”. Rising operational costs, R&D expenses, and expansion efforts are likely to have pressured profit margins. Monitor bookings backlog growth, automotive sector wins, and 2025 revenue guidance. SoundHound’s ability to convert its backlog into revenue will likely be crucial to its future performance.

📅 Friday, Feb 28th

Frontline (FRO): Frontline is likely to report its Q4 2024 earnings with revenue expected to rise 6.33% year-over-year to $273.16 million. However, EPS is projected to drop 41.3% to $0.27, likely due to increasing operational costs, market volatility, and expenses tied to fleet expansion. Higher fuel prices, elevated crew wages, and fluctuating shipping rates will likely have squeezed profit margins. You might want to monitor shipping rate trends, cost management strategies, and global trade policies. Frontline’s ability to handle these challenges will likely be crucial to its future performance.

We hope this helps and happy trading!

– Trade and Travel Team

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.