As we enter this week, U.S. markets are adjusting to the newly announced tariffs on steel and aluminum imports, which will increase to a flat 25% from all U.S. trade partners effective March 12.

Despite the looming threat of reciprocal tariffs from nations worldwide, the market responded positively last week, with QQQ (Nasdaq) and SPY (S&P 500) gaining around 2.91% and 1.49%, respectively. This may reflect optimism about domestic industry benefits or the anticipation of short-lived trade tensions.

On the economic front, the Flash PMI will be released on Friday. It will provide crucial insights into how global businesses navigate the current trade landscape.

Earnings season continues with reports from Walmart, Medtronic, and Booking Holdings among many other companies, potentially influencing market sentiment, especially with inflation having risen to a 3% annual rate last month. Additionally, the Federal Reserve's meeting minutes are due this week, and they will shed light on their thinking regarding monetary policy and interest rates.

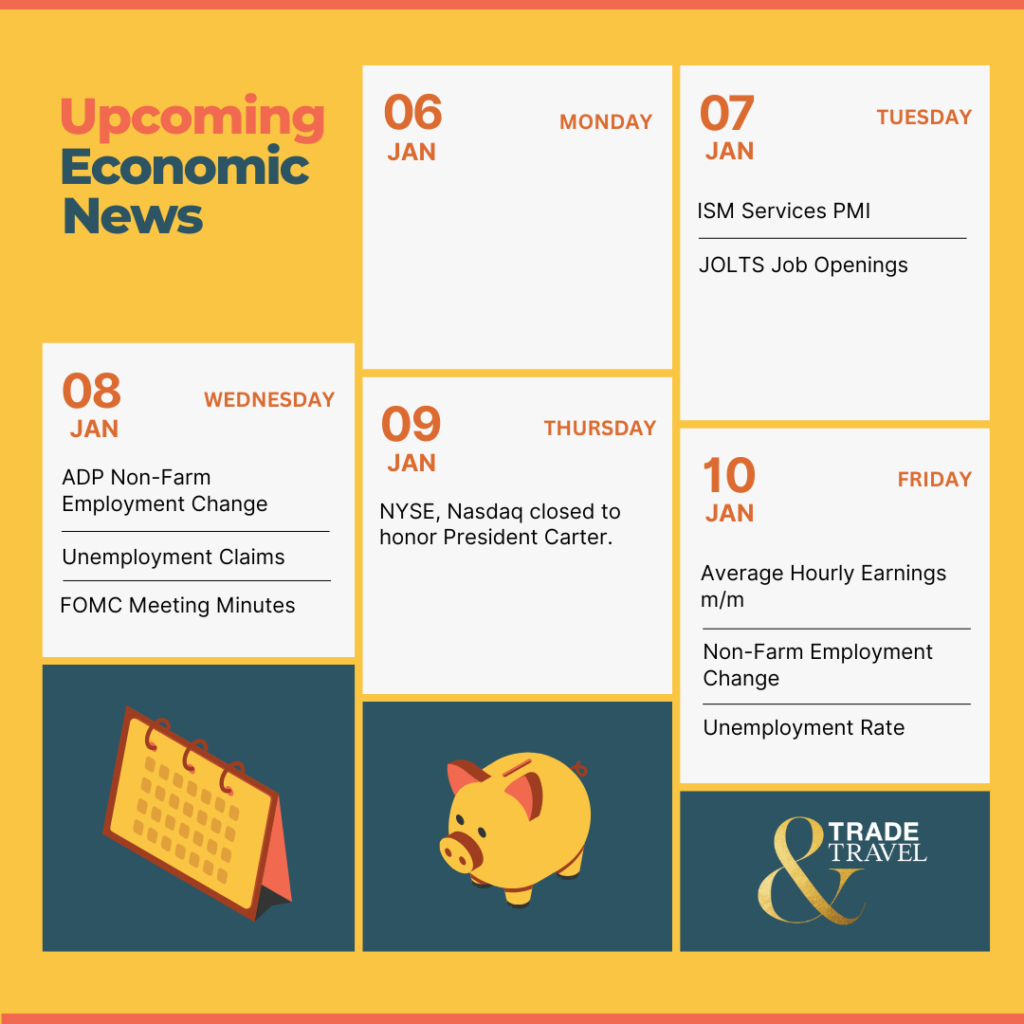

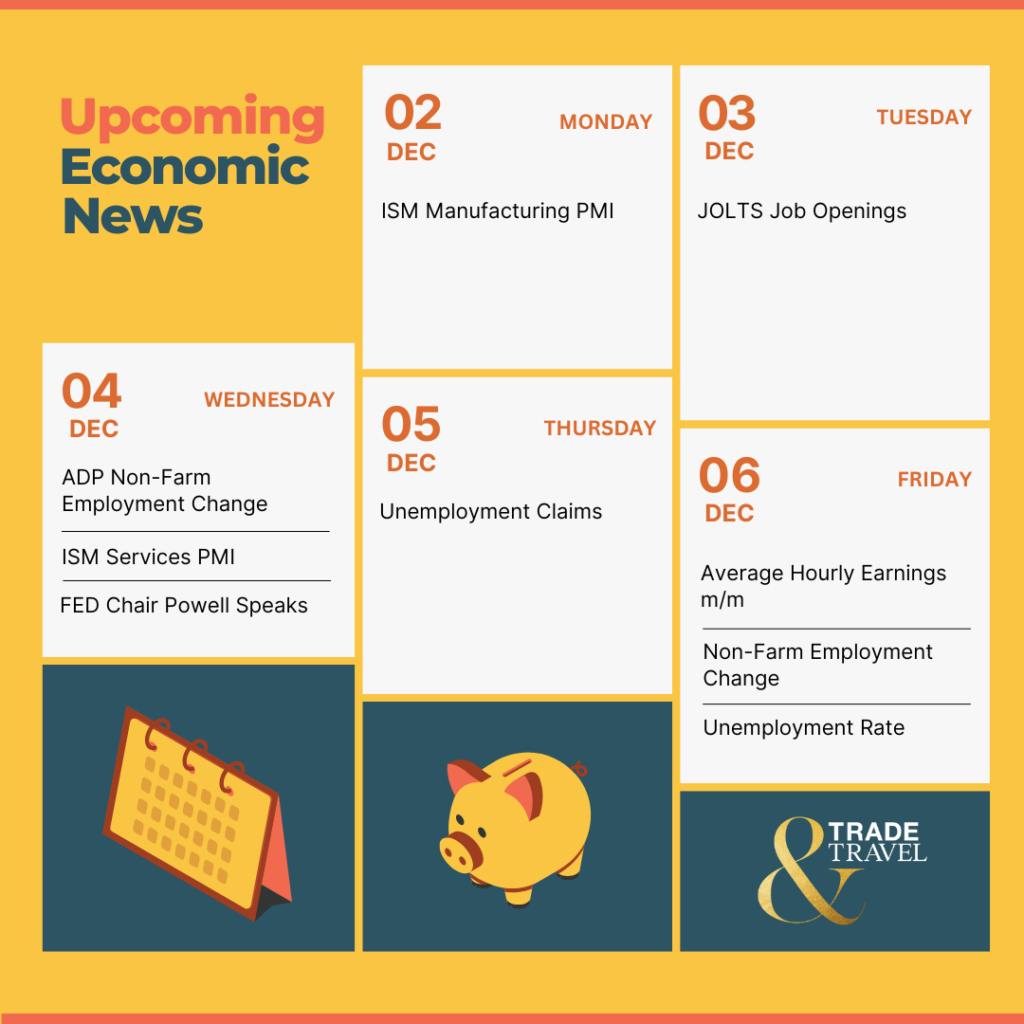

With that in mind, here are the upcoming economic news releases this week:

📅 Wednesday, Feb 19th

- FOMC Meeting Minutes: The FOMC meeting minutes will be released, detailing the discussions from the last meeting where the federal funds rate held steady at 4.25% – 4.50%. Investors and traders should scrutinize the minutes for hints on future rate expectations, including potential cuts or further tightening in upcoming meetings.

📅 Thursday, Feb 20th

- Unemployment Claims: The upcoming report is expected to show initial jobless claims at around 214,000, a slight increase from the last reported 213,000, indicating continued labor market stability. Investors and traders should monitor not just the initial claims but also the continuing claims, currently at 1.85 million, for signs of prolonged unemployment, which could influence the Federal Reserve's interest rate decisions and broader market sentiment.

📅 Friday, Feb 21st

- Flash Manufacturing PMI: The Flash Manufacturing PMI report is expected to show a reading of 51.2, in line with January's surprising upside reading, suggesting a continued modest expansion in manufacturing activity. Keep an eye on changes in new orders, production levels, and employment trends in light of recent tariff implementations, as the PMI serves as a leading indicator of economic health where readings above 50 indicate sector growth.

- Flash Services PMI: The last Flash Services PMI reading came in at 52.9, down from 56.8 the previous month but slightly above the preliminary estimate, marking the slowest expansion since April last year. Despite this, output expanded for two consecutive years with a rise in new orders, while employment saw the fastest growth since 2022. Investors and traders should monitor if the PMI remains above 50, signaling expansion.

Here are some stocks reporting earnings this week to watch:

📅 Tuesday, Feb 18th

- Medtronic (MDT): Medtronic will release its earnings with expectations set for an EPS of $1.36, a 4.62% year-over-year increase, and revenue forecast at $8.33 billion, marking a 2.97% growth from last year's $8.09 billion. Investors should pay attention to the performance of Medtronic's diabetes segment, which grew last year, alongside any updates on new product innovations like the PulseSelect PFA and Evolut FX+, which could significantly influence future revenue streams.

📅 Wednesday, Feb 19th

- Analog Devices (ADI): Analog Devices is set to report its earnings with analysts projecting an EPS of $1.54, down 11% from the previous year, and revenue at $2.36 billion, a 5.98% decrease. Investors should pay attention to ADI's performance in the industrial segment, which has shown resilience despite market challenges with demand in AI-related applications and Aerospace & Defense. While ADI experienced revenue decline over the last twelve months, analysts remain optimistic about recovery prospects.

📅 Thursday, Feb 20th

- Walmart (WMT): Walmart is set to report its fiscal earnings with analysts expecting an EPS of $0.65, an 8.34% increase from last year, and revenue projected at $178.83 billion, up about 4% year-over-year. Investors and traders should closely monitor Walmart's e-commerce growth, up 27% in the last quarter, alongside U.S. comp sales growth of 5.3%, and any guidance updates for FY25, especially given the rise in net sales growth expectations to 4.8% – 5.1%.

- Booking Holdings (BKNG): Booking Holdings is set to release its earnings with analysts anticipating an EPS of $35.96, reflecting a 12.38% year-over-year increase, and revenue expected at $5.18 billion, up 8.37%. Investors should monitor growth in alternative accommodations, which competes with Airbnb and saw a 14% increase last quarter, and advancements in AI initiatives like its AI travel assistant ‘Penny,' as these could significantly enhance operational efficiency and user experience while shaping future profitability.

Looking forward to the week and happy trading!

– Trade and Travel Team

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.