Last week was anything but boring for the stock market.

Earnings were disappointing, dragging stocks down, but Hilton stood out with strong results, showing growth in business, leisure travel, and events. They have been expanding rapidly, opening two new hotels per day in 2024, making Hilton (HLT) a potential stock to watch.

This week, all eyes are on Fed Chair Jerome Powell as he testifies on Tuesday and Wednesday. His comments on inflation and interest rates could influence market direction.

Earnings season continues this week, with reports from McDonald’s, Marriott, Coca-Cola, and Airbnb providing more insight into consumer spending and travel trends. In addition, key inflation reports, including CPI and PPI, along with retail sales data on Friday, could impact investor and trader sentiment.

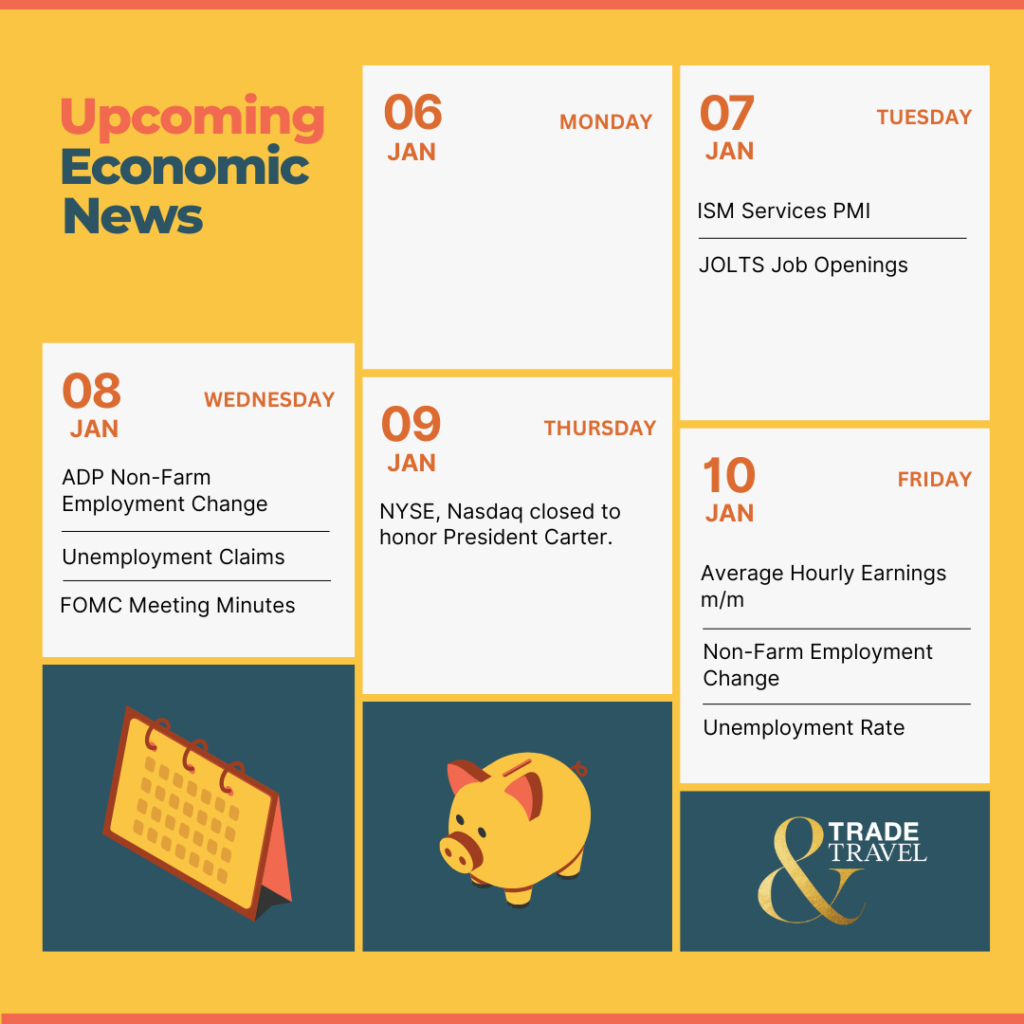

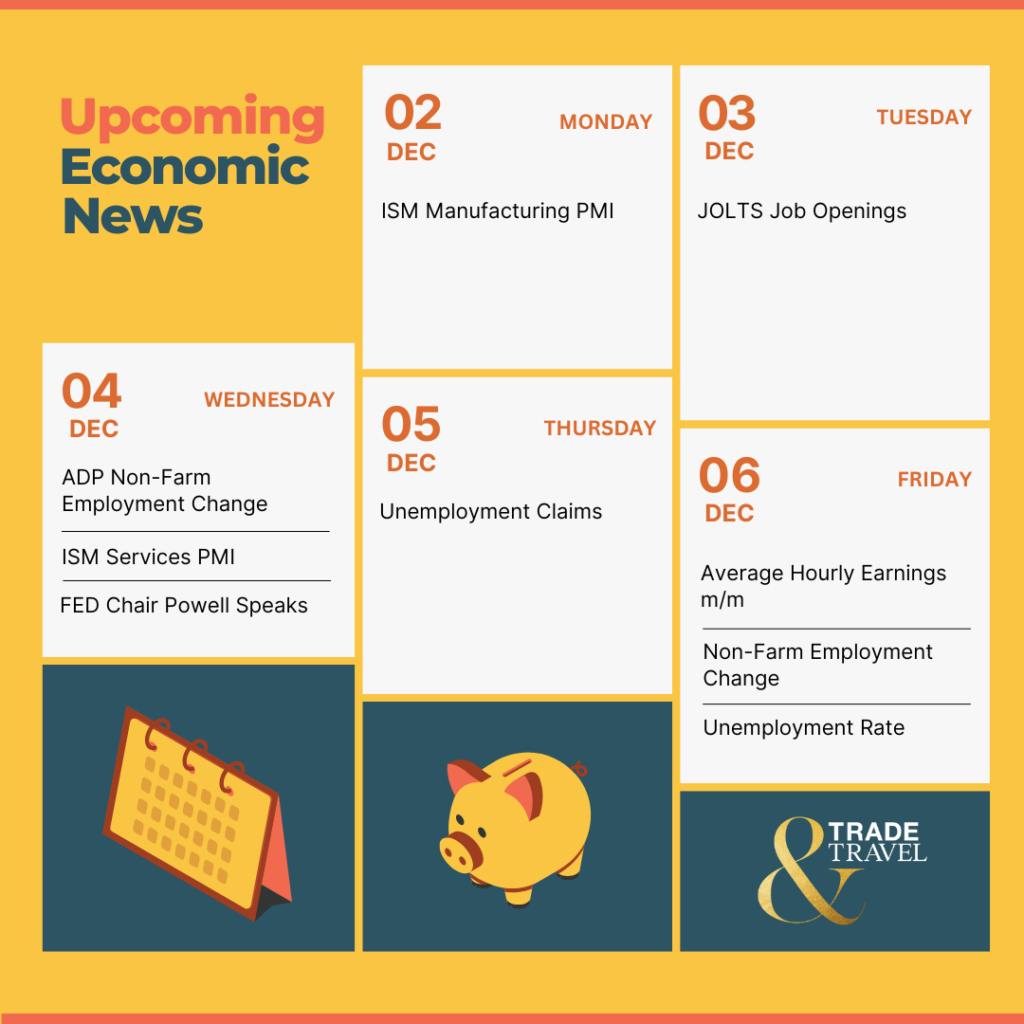

Here’s what to watch in this week’s economic reports:

📅 Tuesday, Feb 11th

- Fed Chair Powell Testifies: Chair of the Federal Reserve, Jerome Powell, is scheduled to testify before Congress on Tuesday and Wednesday to discuss the Fed's semiannual Monetary Policy Report. We will be particularly interested in his comments on the 2% inflation target, and any indications of potential adjustments to the federal funds rate, which has been held steady at a range of 4.25% to 4.50%.

📅 Wednesday, Feb 12th

- Core CPI m/m: The Core Consumer Price Index (CPI) month-over-month report is scheduled for release with expectations set at a 0.3% increase, following a 0.2% rise in December. This figure will be critical in understanding the underlying inflation trends, excluding the more volatile food and energy components, which could influence future interest rate decisions by the Federal Reserve.

- CPI m/m: The Consumer Price Index (CPI) month-over-month report, which includes the more volatile food and energy components, is expected to show a 0.3% increase from December's 0.4% rise. We will also be closely examining this data for signs of persistent inflation or cooling price pressures.

- CPI y/y: The annual Consumer Price Index (CPI) report is anticipated to show a year-over-year inflation rate of around 2.9%, consistent with December's 2.9%. We will be keen to watch this figure to gauge the effectiveness of current monetary policies in curbing inflation, particularly looking for signs of whether inflation is sustainably trending towards the Federal Reserve's 2% target or heating up.

📅 Thursday, Feb 13th

- Core PPI m/m: The upcoming Core Producer Price Index (PPI) month-over-month report, is expected to show a 0.3% increase following a flat reading in December. This report will be key in assessing underlying inflation trends, excluding volatile food and energy prices.

- PPI m/m: The Producer Price Index (PPI) month-over-month report is set for release expectations pegged at a 0.2% rise, consistent with December's 0.2% increase. We will be watching closely for signs of inflationary pressures or deflationary relief, particularly in key sectors like energy, where prices might influence the broader economic outlook.

- Unemployment Claims: U.S. initial jobless claims rose by 11,000 to 219,000 in the week ending February 1, exceeding expectations. Despite remaining historically strong, the data support expectations of slight labor market softening, with the four-week moving average likely rising. Non-seasonally adjusted claims also increased, driven by gains in states like New York and California.

📅 Friday, Feb 14th

- Core Retail Sales m/m: The Core Retail Sales m/m report for December showed a 0.4% increase, aligning closely with market expectations and indicating a stable consumer spending environment excluding the volatile auto sector. We will be watching this data to assess consumer confidence and spending trends, looking for signs of continued growth or potential slowdowns that could influence economic forecasts for the upcoming quarters.

- Retail Sales m/m: The Retail Sales month-over-month report is expected to be flat at a 0.0% reading following a 0.4% rise in December 2024 after the holiday season. We are keeping an eye on consumer spending to gauge consumer confidence and economic health, as these figures can influence expectations for Federal Reserve policy moves.

Here are some stocks reporting earnings this week to watch:

📅 Monday, Feb 10th

- McDonald's Corp (MCD): McDonald's is set to report its Q4 earnings on Monday. An area of focus is whether the company can surpass the expected EPS of $2.86 and if global same-store sales growth can exceed the forecasted result, given the recent trends in consumer spending and operational efficiencies.

📅 Tuesday, Feb 11th

- Marriott International (MAR): Marriott is set to release its Q4 earnings, and analysts expect an EPS of $2.38. This is a 33.3% year-over-year decline amid the ongoing normalization of travel demand. The focus areas are key metrics such as RevPAR (Revenue Per Available Room) growth and gross fee revenues, which assess the company's performance in a competitive hospitality landscape.

- Coca-Cola Co (KO): Coca-Cola is set to announce its Q4 earnings. Wall Street anticipates an EPS of $0.52, up from $0.49 last year, and revenue forecasts at $10.70 billion. Investors and traders should pay close attention to global sales volumes, especially in emerging markets, and any insights into pricing strategies and operational efficiencies that could affect margin growth amidst ongoing inflationary pressures.

📅 Wednesday, Feb 12th

- Robinhood (HOOD): Robinhood is scheduled to release its Q4 2024 earnings with a focus on whether the company can maintain its trajectory of user growth. Investors and traders should pay close attention to transaction-based revenues, which were $319 million in Q3 2024, to assess any signs of increased trading activity or shifts in user engagement amidst evolving market conditions.

📅 Thursday, Feb 13th

- Airbnb Inc (ABNB): Airbnb is set to report its earnings with expectations set for an EPS of $0.58. Areas to watch are the gross booking value, which is projected to be between $20.1 billion and $21.2 billion, and the company's guidance for the next quarter, focusing on how international travel trends and regulatory changes might impact future performance.

📅 Friday, Feb 14th

- Moderna Inc: Moderna is set to announce its earnings with investors and traders particularly focused on how the company's revenue might fare against the consensus estimate of $951.09 million for the quarter. Expectations are for a per-share loss of $2.70, which is a significant decrease from last year's earnings, so investors and traders should be watching closely for any updates on cost management, vaccine sales, and potential new product developments to gauge future profitability.

We hope this helps and happy trading!

– Trade and Travel Team

1 Comments

Leave a Comment

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.

Salute!

I wanted to take a moment to express my gratitude for your letters. They have become incredibly helpful to me, and I find myself reflecting on them daily and adjusting my strategies accordingly.

It has become an essential tool in my arsenal, and I appreciate the effort you put into it.

Thank you once again!

Best regards.

J. Dean