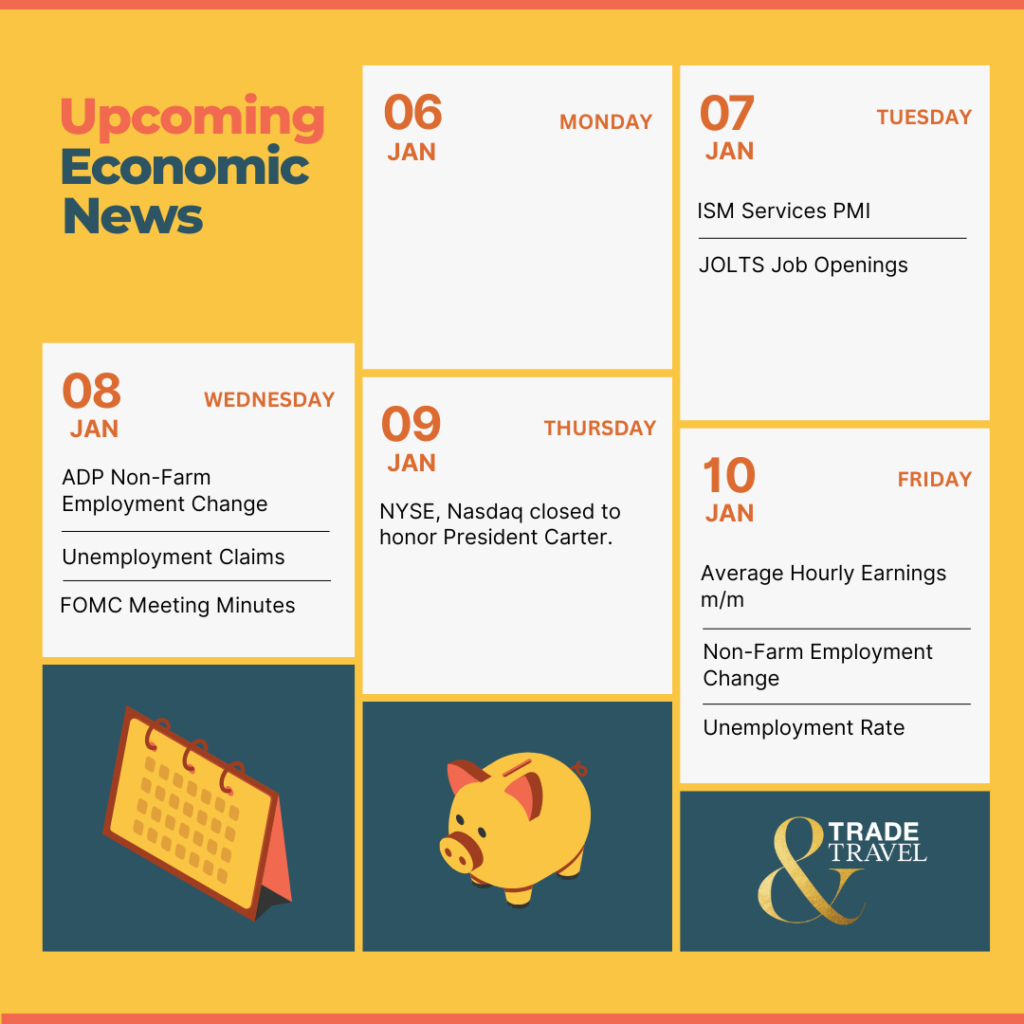

Heads-up, investors and traders! It’s a busy week for markets as key economic data and events could shake up sentiment. Here’s your quick guide:

📅 Monday, Dec 2

ISM Manufacturing PMI: Keep an eye on this leading indicator, as any surprise movement could provide clues about the manufacturing sector’s trajectory.

📅 Tuesday, Dec 3

JOLTS Job Openings: A tight labor market continues to dominate headlines—this data sheds light on job availability and labor demand.

📅 Wednesday, Dec 4

ADP Non-Farm Payrolls: A precursor to Friday’s big job numbers, ADP data offers an early glimpse at private sector hiring trends.

ISM Services PMI: Services continue to drive the U.S. economy. Pay close attention to this health check on the largest sector.

Fed Chair Powell Speaks: Markets will be hanging on every word for hints about the Fed’s rate policy trajectory.

📅 Thursday, Dec 5

Unemployment Claims: Keep tabs on this weekly snapshot to gauge ongoing strength in the labor market.

📅 Friday, Dec 6 – The Big Day

Key employment numbers drop:

• Non-Farm Employment Change

• Average Hourly Earnings m/m

• Unemployment Rate

These reports are market drivers and will provide valuable insights into labor market health, wage pressures, and inflation outlooks.

Tuesday, December 3

- Salesforce (CRM)

Salesforce is projected to report strong earnings with an estimated EPS of $2.45, reflecting significant year-over-year growth. The company continues to thrive in the CRM market, driven by its focus on generative AI and digital transformation solutions.

Wednesday, December 4

- Campbell Soup (CPB)

Campbell Soup is expected to deliver its results with an earnings estimate of $0.87 per share, despite a projected decline from the previous year. The company is undergoing a transformation aimed at optimizing its portfolio and improving operational efficiency.

- Dollar Tree (DLTR)

Dollar Tree is set to report its earnings amid changing consumer spending patterns, with analysts forecasting weaker-than-expected sales. The company aims to maintain its value proposition while navigating inflationary pressures affecting the retail sector.

Thursday, December 5

- Lululemon (LULU)

Lululemon is expected to showcase strong earnings growth with estimates suggesting an EPS of $2.72, driven by robust performance across channels and regions. The company's focus on expanding its international business and men's product lines is likely to contribute positively to its results.

- Hewlett Packard Enterprise (HPE)

Hewlett Packard Enterprise is expected to highlight its ongoing transformation in enterprise technology solutions, with analysts forecasting solid earnings performance. The upcoming report will provide insights into how HPE is adapting to evolving demands in areas like AI and cloud computing.

🔑 Major Pointers to Note:

- Labor data is front and center this week. Friday’s job numbers will likely influence Fed sentiment on future rate decisions.

- Fed Chair Powell’s speech on Wednesday can offer clues about whether the Fed sees more rate moves ahead.

- Watch for momentum shifts across markets, especially in manufacturing and services.

Related Blogs

Follow Us

Testimonials

Hear from students on why they chose the Trade and Travel Family and how it has changed their lives.